ICIJ

Q&A

‘Delaware is everywhere’: how a little-known tax haven made the rules for corporate America

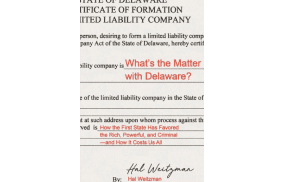

In his new book “What’s the Matter with Delaware?” former Financial Times reporter Hal Weitzman explores the tiny state’s massive role in global financial secrecy.

The words “tax haven” typically invoke visions of far-off tropical hideaways like Panama, Bermuda and the Caymans. But one of the world’s biggest tax havens actually sits within the bounds of mainland USA: the tiny, tax-free state of Delaware.

Hal Weitzman, an author, business school professor at the University of Chicago Booth School and former Financial Times reporter, explores a little-known side of Delaware in his new book, “What’s the Matter with Delaware?” which sheds light on the lax corporate tax laws that have allowed the more than one million companies registered in Delaware to cloak themselves in secrecy and, in some cases, engage in illicit or dodgy financial activity.

ICIJ spoke with Weitzman about how Delaware has become one of the best-kept secrets in offshore finance, and the role the state plays in our daily lives. His book was published in the U.S. in May, and is available in the U.K. on July 19.

You spent 12 years as a reporter for the Financial Times. Was Delaware always on your mind?

No, it wasn’t. It wasn’t something that I ever covered for the Financial Times. The only thing I was aware of was that for some reason that I did not understand, everything seemed to happen in Delaware: all the court proceedings, mergers and acquisitions, bankruptcies. There was a lot going on in Delaware. Obviously, I looked at my credit card, and saw that it came from Delaware. So I knew of it hazily, but I didn’t really understand it, which is what got me intrigued when I had some time to dig into it.

What sparked your interest in writing this book?

I must give the credit to my editor, Joe Jackson at Princeton University Press, formerly at University of Chicago Press. We kicked around the idea of just asking that question: Why Delaware? What is the history? And how did they develop that business? And what does it mean for Delaware? And we tried a couple of people who initially expressed some interest, but then they got distracted by the bigger picture, by money laundering or by tax avoidance, and these are sort of big global issues. I always thought that Delaware was a great idea because it was a way to ground these issues in somewhere real — like to tell these big, complex, global stories, but put them in a physical location, which gives you a chance to talk about the reality of how corporate wrongdoing actually happens, and why Americans found it so hard to address it.

Why has Delaware, as a tax haven, flown under the radar?

Delaware was sort of like someone in the Witness Protection Program. It was like a perfect cover story. Typically, when you think about these issues, you think about somewhere exotic, or exotic to us anyway, like the Cayman Islands or the British Virgin Islands or Panama or Bermuda or Cyprus, Luxembourg or Switzerland. It’s the sort of places like a James Bond film; it’s always something that happens over there. We never think of it as being something that happens over here and in the very non-exotic location of Delaware, right? So the sheer sort of ordinariness of it was in itself kind of remarkable.

What makes Delaware a tax haven?

Companies and wealthy individuals can use Delaware to avoid paying some taxes in other states. So there’s a thing called the Delaware Loophole, which essentially enables companies to avoid paying state corporate income tax where they earn the revenue. Home Depot and Toys R Us and a lot of retailers have used that loophole. And then Delaware is one of five states that don’t have a sales tax. So it’s very common for people to cross state lines to shop in those states; duty free shopping is a big thing. So people cross over and they buy stuff, duty free. It’s not strictly legal, but it’s small stuff. It’s not a huge misdemeanor, as things stand. But if you’re a wealthy individual buying, for example, a piece of art in New York at auction, you can put that in a truck and ship it straight to a warehouse in Delaware, and you don’t pay any tax to the state of New York. So in both these cases, it’s helping people — in the case of art, helping them avoid taxes in their home state; in the case of the Delaware Loophole, it’s helping corporations avoid paying corporate income tax.

After Russia’s invasion of Ukraine, you wrote an op-ed in March entitled “America’s indulgence of corporate secrecy (like Delaware LLCs) makes it harder to squeeze Putin” for MarketWatch. Why has the state received renewed attention since the war began?

Well, because some of the big financial centers, particularly London, had been under a lot of scrutiny because they’ve been trying to strangle the wealth of these Russian oligarchs, and they found it challenging to do so, which just shows you how entrenched that money is in our system. But the fact is that in America, there’s even less transparency than there is in the U.K.

Here in America, we have no idea because we don’t ask the question, who owns the company? The policy that Delaware has championed and defended, the system against attempts to reform it, is ‘don’t ask, don’t tell.’ I spoke to the secretary of state in Delaware last year, to their office, and I just wanted to be 100% clear before I said it publicly: “Do you know where the owners of corporations registered in Delaware are located?” And they said they don’t. And there’s no way of knowing because they just don’t even ask the information.

Have efforts to reform Delaware’s secrecy-friendly policies, like the federal Corporate Transparency Act, been sufficient?

That law won’t change that registration system. You will still be able to register in Delaware anonymously with no documentation, not an ID required, nothing. Then you can still put someone else’s name, the agent’s name, instead of your own. And that will be completely legal. So that system, the system of anonymity at the point of registration, that continues. That’s now institutionalized and reinforced by this new law. So I do think in America, it’s even further behind than the U.K.

Read more

‘Delaware is everywhere’: how a little-known tax haven made the rules for corporate America