No beating about the bush in this article penned by Michael Feit principal at Feit Consulting and we congratulate him for his piece.

As much as we would like to hope that law firms will drop either or both services we know, as do most of you, it’s still a matter of where else is the information available and how easy is it to access. Both organisations have tied up the content originators in deals or arrangements that make it very difficult for new database/content providers to get access to content and data so as to enter the market and provide better search , more content at a 1/3rd of the price

Here in Australia HOB is working with a company that provides NLP AI search designed specifically for law. The technology is fantastic, the delivery of service and UX / UI isn’t quite there and needs to be improved (not rocket science , just time and attention to detail) but the main issue is access to data sets.

Wexis and we hasten to add other providers in the market including the likes of Austlii combined with recalcitrant state and federal bodies make it nigh on impossible to access data sets in order to provide a modicum of competition in the market as organisations protect the past and the client suffers both in quality of service and the ridiculous sums of money they have to pay.

With advances in technology , a little organisation and common sense, new technology companies could be providing AI enabled search specifically designed for the law at about 20% of the cost to clients both in the private sector as well as the public.

The question is, will new technology be allowed access to the data sets and that in the end is a decision for government, the courts and relevant bodies to decide. Unfortunately they won’t, from our experience of 30 years reporting on this issue

Feit writes

The pandemic crisis has hit law firms, many of which are making very difficult decisions to lay off, furlough, and cut salaries. It simply is not plausible that in this climate law firms will be able to continue to justify retaining two generally redundant and expensive products: Lexis and Westlaw. Based upon our market expertise, we predict Westlaw will lose out on a push to sole provider if this trend materializes as expected–unless Westlaw changes their pricing approach.

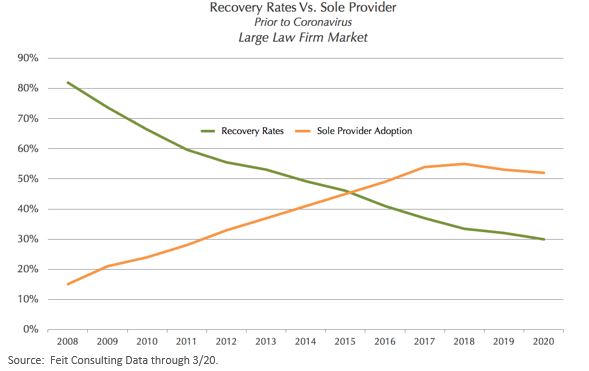

Up until the previous recession in 2008, nearly all firms had retained both Lexis and Westlaw (85%) because both were considered too unique and too important to be without. No one really saw the need to challenge this notion because clients generally paid. When recovery for online legal research declined, the sole provided trend emerged and with it, firms proved moving to just Westlaw or Lexis can be done without repercussions.

The below chart illustrates the trend through today for firms with more than 100 attorneys.

As you see in the chart, the decline of recovery rates was inversely proportionate to the rise of the sole provider trend up until 2018 peaking at 55%.

Of the large law firms currently with both vendors many have brought back a deleted vendor with best in market pricing. Since the economy was strong, firms were just not sufficiently motivated to unseat Westlaw. For the most part, Lexis is now priced low enough that for many firms the savings on kick-out would not be motivating. Another reason that firms are retaining Lexis of late is due to their deployment of strategies bundling their very popular peripheral products to a Lexis subscription.

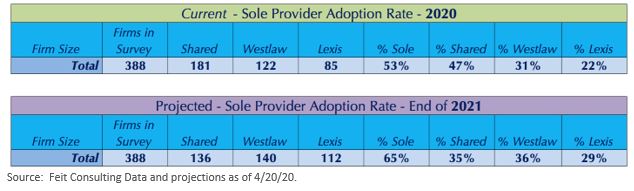

Everything has changed. With savings of hundreds of thousands and/or millions of dollars available, the business case for Westlaw or Lexis deletion is too strong to ignore. There are currently 85 large law firms operating without Westlaw and 122 firms without Lexis.

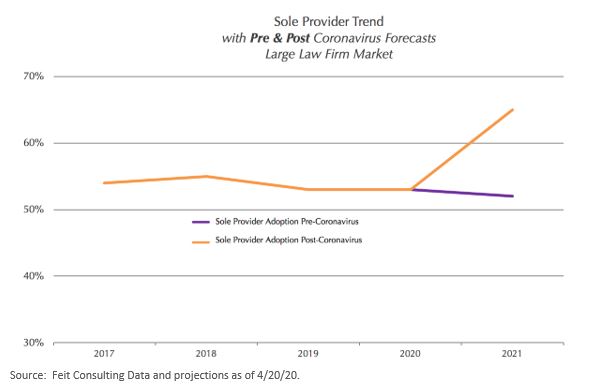

The impact of the Coronavirus pandemic will be to re-accelerate the movement to either delete Westlaw or Lexis or ‘flip’ vendors if the firm is already sole provider. In most situations eliminating Westlaw will yield the largest savings.

As illustrated in the chart above, Feit anticipates that over the next 18-20 months the number of firms moving to sole provider will increase dramatically. Because legal information contracts are typically on 3-year cycles, the uptick of the trend will be slow but ultimately dramatic.

We anticipate that nearly half the firms that are up for renegotiation who still have both vendors will eliminate either Westlaw or Lexis. Of these, 3 out of 5 will eliminate Westlaw because it yields the best return and firms will easily be able to retain other important products such as Practical Law or print. Of the firms that only have Lexis or Westlaw, we anticipate a large percentage to “flip” vendors if their current vendors do not offer any concessions now. Firms flipping from Westlaw to Lexis will happen more frequently due to the savings opportunity.

We now estimate that nearly 50% of shared firms with both Westlaw and Lexis that are up through end of 2021 will eliminate one of the vendors. Unless Westlaw and Lexis are willing to work creatively with firms who are looking for financial relief, we expect the number of firms with just one vendor to increase from the current 53%, to potentially 65%.

Westlaw and Lexis will need to realize that there are ways to restructure contracts in a mutually beneficial way. Otherwise, firms will be making difficult choices – including terminating long-term relationships.

Source: https://www.feitconsulting.com/lexis-or-westlaw-the-business-case-for-deletion-is-too-strong/