The numbers, unsurprisingly get ever more scary. Credible.com reports, “7 out of 10 law school graduates borrow to earn their degrees, leaving school with close to $150,000 in total student loan debt on average. It can be a challenge paying back your loans if your annual income is less than your student loan debt.”

Average Student Loan Debt for Law School in 2019

Source: https://www.credible.com/blog/statistics/average-law-school-debt/

Law school graduates leave school with close to $150,000 in total student loan debt on average.

Every year, more than 40,000 students are admitted to law school with high hopes of graduating from a top law school and earning a six-figure salary.

But 7 out of 10 law school graduates borrow to earn their degrees, leaving school with close to $150,000 in total student loan debt on average. It can be a challenge paying back your loans if your annual income is less than your student loan debt.

Here’s a look at the average law school debt and earnings for graduates nationwide:

- Average law school debt ? $134,600

- Average education debt after law school ? $148,800

- Median earnings with a law school degree ? $120,910

- Average earnings with a law school degree ? $144,230

- Average time to repay law school debt ? 18 years

Here are the charts and data you’ll find below:

- Average law school debt

- Cost to repay law school debt

- Average earnings with a law school degree

- How to pay off law school debt

Average law school debt

According to the most recent numbers from the National Center for Education Statistics, the total student loan debt of law school students at graduation has nearly doubled since 1999-2000.

The chart above shows average total education debt for law school graduates is:

- For the class of 1999-2000: $84,300

- For the class of 2015-2016: $148,800

That’s an increase of 76%, even after adjusting for inflation.

Total education debt includes both law school and prelaw debt taken on to earn a bachelor’s degree.

Excluding pre-law debt and looking only at loans taken out for law school, average law school debt at graduation averaged:

- For the class of 1999-2000: $75,900

- For the class of 2015-2016: $134,600

That’s an increase of 77%, using 2017-18 dollars to account for inflation.

See More: U.S. Student Loan Debt Statistics

[ Jump to top ]

Cost to repay law school debt

Law school students take on far more debt than other grad students. The cost to repay law school debt depends primarily on three factors:

- The interest rates on your loans

- How how long it takes you to pay your loans back

- Whether you’ll qualify for loan forgiveness

Average interest rates on law school loans

There are three interest rate tiers for federal student loans — one for undergraduates, one for graduate students, and one for PLUS loans. Many lawyers will have all three types of loans by the time they graduate from law school.

Based on average student loan interest rates in recent years, a typical law school graduate would have the following loan balances and interest rates:

| Loan Type And Amount Borrowed | Average Interest Rate |

|---|---|

| $14,200 undergraduate loans | 4.79% |

| $61,500 in direct unsubsidized loans for grad students | 6.36% |

| $73,100 in PLUS loans | 7.41% |

| Total: $148,800 | Weighted average interest rate: 6.7% |

Typical loan balances and interest rates for law school grads

Graduate and professional students are allowed to take out a lifetime total of $138,500 in subsidized and unsubsidized direct loans. But the annual borrowing limits for grad students on these more affordable loans is $20,500.

What that means is that students earning a law degree in three years will be able to borrow no more than $61,500 in direct unsubsidized loans for grad students. After that, law students will be looking at costlier grad PLUS loans or private loans to meet their unmet funding needs.

Learn More: How to Pay for Law School

Average time to repay law school loans

How long it takes you to repay your law school loans depends on your choice of repayment plan, income, and whether you’ll qualify for Public Service Loan Forgiveness as a government or nonprofit worker.

For law school grads the average time to repay student loans after graduation is:

- Public Service Loan Forgiveness: 10 years

- Standard repayment plan: 10 years

- Income-driven repayment (REPAYE): 17 years

The table below shows how lawyers who won’t qualify for Public Service Loan Forgiveness may be able to pay their loans off faster by refinancing them at a lower interest rate, potentially saving thousands in repayment costs.

| Repayment Plan | Monthly Payment | Years Of Payments | Total Repayment Cost |

|---|---|---|---|

| REPAYE with Public Service Loan Forgiveness | $327-$557 (first, last) | 10 | $52,090 ($172,890 forgiven) |

| Standard 10-year repayment plan | $1,708 (fixed) | 10 | $204,925 |

| REPAYE without Public Service Loan Forgiveness | $851-$1,972 (first, last) | 16 years, 11 months | $271,121 |

| Refinance into 10-year loan at 5% | $1,578 (fixed) | 10 years | $189,391 |

| Average cost to repay law school debt of $148,800 with a weighted average 6.7% interest rate at graduation. | |||

The REPAYE with Public Service Loan Service example above assumes that a lawyer will start out earning $58,000, the median entry-level salary for public defenders in 2018. The other REPAYE example assumes a recent grad is able to earn the median salary of $120,910 right out of law school. Some will earn more, and others less (see earnings statistics below).

[ Jump to top ]

Average earnings with a law school degree

Although most lawyers graduate with six-figure education debt, many land jobs with annual salaries that are equal or almost equal to their total debt, making it easier to repay their loans.

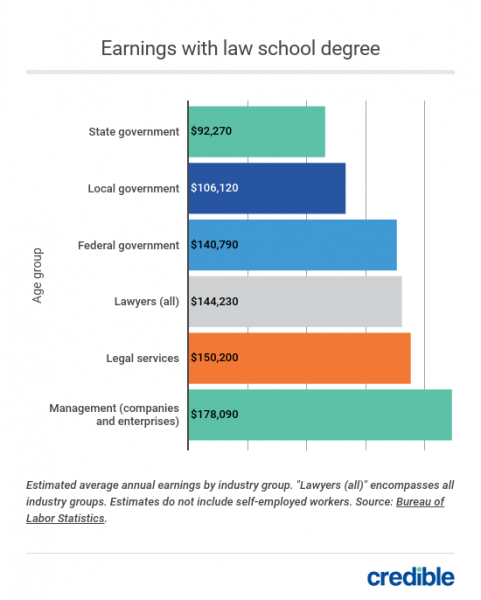

According to the latest figures from the Bureau of Labor Statistics, in 2018 lawyers earned:

- Median: $120,910

- Average: $144,230

The chart above highlights that lawyers who work for state and local governments can expect to earn less than the average law school graduate. Working for the federal government can provide a more generous salary.

Landing a job with a law firm as a provider of legal services, or as a member of a company or enterprise legal staff, often provides the biggest paycheck.

Law school debt and earnings by school

Borrowing and earnings can vary tremendously by school. Although the more prestigious law schools can leave graduates deeply in debt, they’ll typically command higher salaries that make it possible to repay their debt. Less selective schools often leave graduates deeply in debt, without as clear a path to a six-figure income.

| School | Median Debt | Median Income | Debt-To-Income Ratio |

|---|---|---|---|

| Harvard University | $133,617 | $158,200 | 0.84 |

| Columbia University in the City of New York | $165,314 | $180,300 | 0.92 |

| New York University | $183,857 | $175,800 | 1.05 |

| University of California-Berkeley | $151,136 | $135,400 | 1.12 |

| University of Michigan-Ann Arbor | $145,182 | $126,800 | 1.14 |

| The University of Texas at Austin | $106,598 | $90,100 | 1.18 |

| University of California-Los Angeles | $121,453 | $96,600 | 1.26 |

| University of Florida | $84,508 | $56,900 | 1.49 |

| Fordham University | $151,250 | $99,000 | 1.53 |

| Georgetown University | $163,688 | $105,000 | 1.56 |

| Brooklyn Law School | $119,909 | $66,100 | 1.81 |

| University of California-Hastings College of Law | $137,787 | $67,600 | 2.04 |

| George Washington University | $163,300 | $74,300 | 2.2 |

| Loyola Marymount University | $144,200 | $63,700 | 2.26 |

| South Texas College of Law Houston | $132,415 | $56,900 | 2.33 |

| Stetson University | $137,217 | $49,300 | 2.78 |

| American University | $177,226 | $55,300 | 3.2 |

| Southwestern Law School | $193,653 | $45,000 | 4.3 |

| Western Michigan University-Thomas M. Cooley Law School | $162,011 | $36,000 | 4.5 |

| Florida Coastal School of Law | $198,655 | $35,300 | 5.63 |

| The 20 largest law schools by number of degrees granted, ranked by recent graduates’ debt-to-income ratio. The lower the ratio, the more manageable the debt. Median debt figures are for 2016-2017. Income is for 2015-2016 graduates. Some schools that do not report data excluded. Source: U.S. Department of Education. | |||

Students who take on debt that doesn’t exceed their annual earnings will have the easiest time repaying their loans. The chart above shows that among the nation’s 20 biggest law schools, the average debt-to-annual-income ratio can be much higher than the ideal of one or less.

If you’d like to see the DTI for the nation’s largest law schools, click the accordion below.

[ Jump to top ]

How to pay off law school debt

Although lawyers graduating from the most selective law schools will often earn enough to comfortably repay their loans, choosing a career in public service can make debt harder for anyone to manage. If you’re planning to work as a public defender or prosecutor, or at a nonprofit that provides legal services to underserved communities, you may qualify for Public Service Loan Forgiveness after 10 years in an income-driven repayment program.

Here are three steps to putting together a plan for paying back law school debt:

- Determine whether you’ll qualify for loan forgiveness

- Choose a repayment plan that fits your monthly budget

- Evaluate whether refinancing makes sense

Qualifying for loan forgiveness

Federal student loans offer several paths to loan forgiveness. If you plan to work for the government or a qualified nonprofit, you may qualify for Public Service Loan Forgiveness after 10 years of payments. Check the program requirements. If you think you might qualify, you’ll need to enroll in an income-driven repayment program.

If you don’t plan a career in public service, you may still qualify for federal loan forgiveness after making 20 or 25 years of payments on your loans. This usually only be the case if your total student loan debt is considerably more than your annual earnings after graduation.

Many schools, states, and employers also offer special forgiveness programs for lawyers.

Learn More: Law School Loan Forgiveness and Repayment Programs

Choosing a repayment plan

Regardless of whether you’ll qualify for loan forgiveness, the Department of Education’s repayment estimator is a useful tool for choosing a repayment plan. Just make sure you’re aware of its shortcomings.

The repayment estimator won’t tell you how much unpaid interest might be added to your loan balance if you leave an income-driven repayment plan voluntarily (to refinance, for instance).

Learn More: Federal Student Loan Repayment Options

Refinancing law school debt

Interest rates on federal student loans are “one-size-fits-all.” But borrowers with good credit and earnings often qualify for lower rates from private lenders.

When exploring refinancing, make sure to get rates from multiple lenders. Also keep in mind that if you’re refinancing federal loans, you may lose benefits like access to income-driven repayment plans with the potential for loan forgiveness.

Many lawyers decide the savings they can achieve by refinancing are worth more to them than the borrower benefits they lose.